Loan Calculator Payment Every 2 Weeks

Therefore over the course of one year you will have made 13 full payments. Biweekly payments accelerate your auto loan payoff by paying 12 of your normal monthly payment every two weeks.

Extra Payment Mortgage Calculator Making Additional Home Loan Payments Mortgage Payment Calculator Mortgage Mortgag Mortgage Loan Calculator Mortgage Loan Originator Mortgage Amortization Calculator

Instead of making a single payment by each months due date you are responsible for a payment every two weeks.

Loan calculator payment every 2 weeks. Therefore if your monthly payment is 1500 a month you would pay 18000 a year with monthly payments. In this example youd end up. Calculating a loan payment amount with this calculator is very easy.

This calculator will demonstrate how making one half of your mortgage payment every two weeks can save you money in the long run. This accelerated schedule will amount to one extra mortgage payment per year and you will see how much faster you could have your loan paid off. This calculator shows you possible savings by using an accelerated biweekly auto loan payment.

Since there are 52 weeks in the year your total number of payments when paying bi-weekly is 26 which actually includes more payments. The grand total paid would be 227544. However this calculator is also able to handle weekly biweekly every 2 weeks - 26 payments per year bimonthly twice a month - 24 payments per year quarterly every 3 months semiannual every 6 months and annual Payment Schedules.

Click either Calc or Payment Schedule. By making payments every other week you are actually paying an additional loan payment each year. With bi-weekly payments you repay half of your normal monthly payment every two weeks instead of every month.

If you made payments every. Making bi-weekly payments is one popular way to pay off your loan quicker. Then once you have computed the payment click on the Create Amortization Schedule button to create a.

Since payments are usually attached to calendar months the total number of repayments each year is 12 one for each monthly billing period. Weekly Payment Loan Calculator -- Make loan payments every week. Making bi-weekly payments will reduce your amount owed and save you interest charges for the outstanding loan balance that would normally still be there until the end of the month.

If you have an existing loan you are making monthly payments on simply start making 12 of your monthly payment every two weeks 26 half-payments per year. Leave Loan Payment Amount set to 0. However there are only 12 months in the year and if you were making two payments each month you would only be making 24 payments a year.

This amounts to 127544 in interest and 100000 in principal. By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. Optionally set the dates.

Free fast and easy to use online. Because there are 52 weeks in a year sending in a payment every two weeks equals out to 26 half-payments each year or 13 full ones. This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan.

Biweekly savings are achieved by simply paying half of your monthly auto loan payment every two weeks and making 15 times your monthly auto loan payment every sixth month. In todays economy you could expect to finish paying off your loan four years sooner by making. If the homeowner set up biweekly loan payments instead they would pay 316 every two weeks for 24 years.

Use this calculator to see how bi-weekly payments. Free loan calculator to determine repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. Also learn more about different types of loans experiment with other loan calculators or explore other calculators addressing finance math fitness health and many more.

The total amount of interest paid would be only. This results in making 13 payments per year versus the normal 12 payments and usually results in significant time and interest savings. If it takes the homeowner the entire 30 years to pay off the loan the homeowner will end up making 360 monthly payments of 632.

This means youll make 26 payments throughout the year which is one full payment more than if you had paid on the first day and middle part of the month. There are 52 weeks in the year which means that on a biweekly payment plan you would make 26 payments per year. Making bi-weekly payments on your mortgage greatly reduces the time it takes to fully repay your loan and significantly reduces the total amount of interest paid.

Instead of going towards interest that extra payment gets applied to your loans principal amount meaning youll end up reaching your loans payoff date sooner. If you instead make 174 payments every two weeks youd be debt-free 13 months sooner and save 1422 in interest. By the end of each year you would have paid the equivalent of one extra monthly payment.

This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. Number of Payments term Annual Interest Rate. Another option for repaying loans is to make bi-weekly payments to cover the debt.

This means that you pay equal to one full payment every four weeks. By paying half of your monthly payment every two weeks each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12. This simple technique can shave years off your auto loan and save you hundreds to.

Click clear and enter values for. This calculator will compute a loans payment amount at various payment intervals -- based on the principal amount borrowed the length of the loan and the annual interest rate. The majority of loans have monthly payments so monthly is pre-selected for you.

By paying half of your monthly payment every two weeks each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12. Making payments once every two weeks.

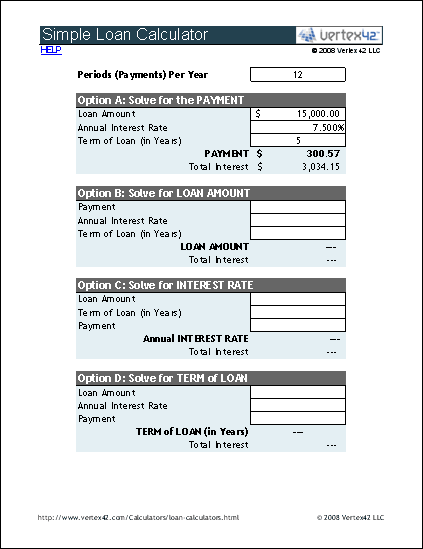

Loan Calculator Free Simple Loan Calculator For Excel

Quicken Loans Payment Mortgage Amortization Calculator Mortgage Amortization Quicken Loans

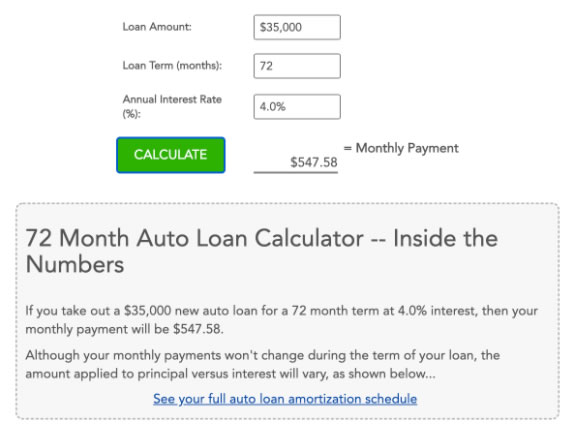

72 Month Auto Loan Calculator Investinganswers

Biweekly Extra Mortgage Payment Calculator With Amortization Mortgage Payment Calculator Mortgage Payment Money Advice

There Is More Than One Way To Lower Your Mortgage Payment In Order To Determine How To Determine Mortgage Paymen Home Equity Line Home Equity Line Of Credit

72 Month Auto Loan Calculator Investinganswers

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Pin On Debt Is Regret Group Board

Biweekly Extra Mortgage Payment Calculator With Amortization Mortgage Payment Calculator Budget Calculator Debt Calculator

How I Paid Off My 86 000 Mortgage In 2 Years Mortgage Payoff Mortgage Payment Calculator Mortgage Refinance Calculator

Euriborrates Mortgage Android App Playslack Com Euriborrates Is List Of A Andro Mortgage Payme Mortgage Payment Calculator Mortgage Calculator Mortgage

Mortgage Calculator Mortgage Calculator Google Searchs New Mortgage Calculator C Mortgage Payment Calculator Mortgage Calculator Tools Mortgage Amortization

Windows 10 Win10 Includes A Built In Stock Tracker Forex Currency Exchange Mortgage Amortization Mortgage Amortization Calculator Mortgage Loan Originator

Mortgage Calculator With Down Payment Dates And Points

Bi Weekly Mortgage Calculator Extra Payment Amortization Table Mortgage Payment Calculator Mortgage Amortization Mortgage Amortization Calculator

Home Mortgage Calculator Download At Www Xltemplates O Mortgage Payoff Calcul Mortgage Amortization Mortgage Amortization Calculator Mortgage Loan Calculator

Posting Komentar untuk "Loan Calculator Payment Every 2 Weeks"