Bond Price Calculator Negative Yield

The Yield to Price calculation is straightforward because we can represent price as a function of yield P FY as illustrated above. It depends on how much less than par value the investor paid for it and how many payments will be made before it reaches its maturity.

Microsoft Excel Bond Valuation Tvmcalcs Com

Bond Calculator Bond calculator is designed to calculate analytical parameters used in assessment of bonds.

Bond price calculator negative yield. We can calculate the yield on a bond investment using the current yield as long as we know the annual cash inflows of the investment and the market price of the security. Face Value Field - The Face Value or Principal of the bond is calculated or entered in this field. When bond yields go up prices go down and when bond yields go down prices go up.

In other words an upward change in the 10-year Treasury bonds yield from 22 to 26 is a negative condition for the bond market because the bonds interest rate moves up when the bond market trends down. Error value in B9 is returned because the PRICE function will not accept a negative value for yield even though the YIELD function calculated it. Bond Prices and Bond Yield have an inverse relationship.

CY C P 100 or CY B CR 100 P. You can use the calculator to see how your bonds price will change to reflect changes in the yield to maturity. Bond Yield Calculator Compute the Current Yield.

You should get the following result. For many simple bonds you can convert yields to a clean price very accurately using the Excel PRICE function. To calculate the duration you need to know all these details time to maturity coupon rate face value price etc but if we are given the duration the details become irrelevant.

For example assume a 1000 bond has a coupon rate of seven percent which means that the bond. CY is the current yield C is the periodic coupon payment P is the price of a bond B is the par value or face value of a bond CR is the coupon rate. Bond prices and yields act like a seesaw.

To calculate simply divide the annual coupon payment by the bonds selling price. On this page is a bond yield calculator to calculate the current yield of a bond. Alternatively the causality of the relationship between yield to maturity Cost of Debt The cost of debt is the return that a company provides to.

The inverse calculation is a bit trickier because there is no simple equation for representing yield as a function of price Y FP. To solve for your bonds new price select I want to solve for price. Subtract the accrued coupon to get the clean price.

Enter this formula in B9. Enter amount in negative value. The calculator uses the following formula to calculate the current yield of a bond.

A bond may have a negative YTM calculation. Note that the discount factor is less than 1 Id the yield is positive and greater than 1 if the yield is negative. The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds Bond Price Field - The Price of the bond is calculated or entered in this field.

The tool allows calculating prices accrued coupon interest various types of bond yields duration as well as modified duration curve PVBP making it possible to analyze volatility of the debt market instruments and assess how. Calculate Bond Yield. Calculate the sum product of the cash flows and the discount factors.

The purpose of the duration is to allow us to quickly calculate hedge ratios. A bond that sells at a premium where price is above par value will have a yield to maturity that is lower than the coupon rate. Thats the dirty price.

Calculate Bond Price if Rates Change. When bond price decreases bond yield increases. This bond price calculator estimates the bonds expected selling price by considering its facepar value coupon rate and its compounding frequency and years until maturity.

There is in depth information on this topic below the tool. Bond prices fluctuate when interest rates change. When bond price increases bond yield decreases.

If all yields move up by 1 how much of bond A would hedge the price move of bond B. Bond price PRICEsettle date maturity date coupon YTM redemption value frequency day count basis So to price a Gilt say the UKT 475 7-Dec-2020 for settlement tomorrow T1 at a yield of 019 you would use the following Bond Price PRICE23-Jun-307-Dec-30. Let us understand the bond yield equation under the current yield in detail.

Current yield is simply the current return an investor would expect if heshe held that investment for one year and this yield is calculated by dividing the annual income of the investment by the investments current market price. Bond Yield Formula Annual Coupon Payment Bond Price. Then input your bonds coupon face value remaining years to.

Calculate the discount factors from yield for each cash flow date. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute a current yield.

Duration And Convexity With Illustrations And Formulas

Microsoft Excel Bond Valuation Tvmcalcs Com

Learn To Calculate Yield To Maturity In Ms Excel

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Duration And Convexity To Measure Bond Risk

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Microsoft Excel Bond Valuation Tvmcalcs Com

2021 Cfa Level I Exam Cfa Study Preparation

Bond Pricing Formula How To Calculate Bond Price Examples

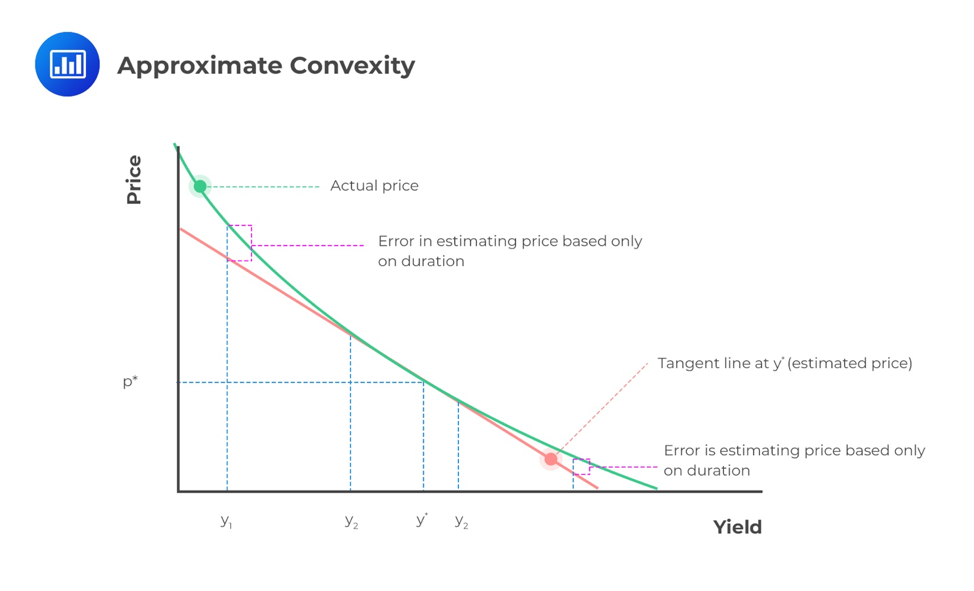

Calculate And Interpret Convexity Cfa Level 1 Analystprep

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

Learn To Calculate Yield To Maturity In Ms Excel

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Interest Rate Risk Of Bonds Full Valuation Approach Aka Scenario Analysis

How To Calculate Yield To Maturity In Excel Free Excel Template

Parametric Yield Curve Fitting To Bond Prices The Nelson Siegel Svensson Method Resources

How To Calculate Yield To Maturity In Excel Free Excel Template

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

Posting Komentar untuk "Bond Price Calculator Negative Yield"